CLS Shelter Fund (CLSHX)

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The Fund’s total annual operating expenses including underlying fund expenses for the CLS Shelter Fund are 1.36%. Performance results reflect a contractual fee waiver by the investment adviser as described in the prospectus of the fund. For performance information current to the most recent month-end, please call toll-free 1-866-811-0225.

Fund Objective & Strategy:

The AdvisorOne CLS Shelter Fund seeks to limit the impact of large market downturns, while also pursuing growth of capital. The Fund primarily invests in exchange traded funds (ETFs) through the use of:

- Growth Stocks

- Large Cap Stocks

- Low Volatility Stocks

- U.S. Treasury bills

There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses.

In times of severe market decline, the Fund’s assets will likely move from ETFs that seek capital growth or appreciation to less volatile stocks and/or U.S. Treasury bills. When the market rebounds to a predetermined level, the Fund’s protected assets will likely move back into broader stock market exposure.

Fund Process:

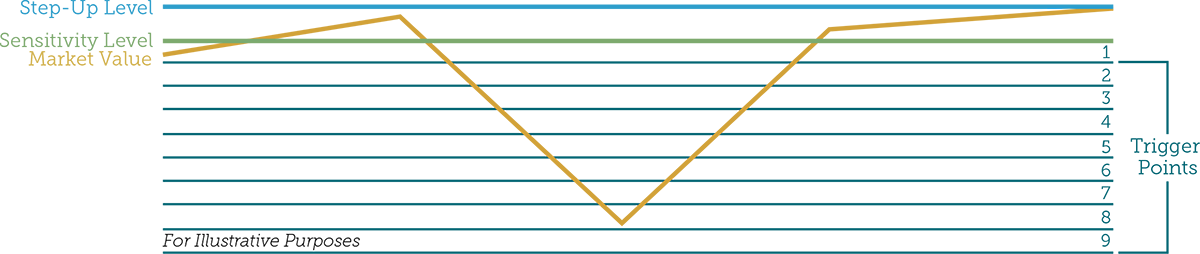

The Fund’s investment adviser, CLS Investments, LLC (CLS), utilizes a sensitivity level, multiple trigger points, and a step-up level to determine when the CLS Shelter Fund must trade into less volatile stocks and/or U.S. Treasury bills in an effort to protect the original investment.

- Sensitivity Level: The market value at which the trigger points become active. This will automatically reset to a higher level if the market value increases to a predetermined level.

- Trigger Points: Signals that cause movement into or out of less volatile stocks and/or U.S. Treasury bills.

- Step-Up Level: The point at which the market value increases enough above the current sensitivity level that the sensitivity level is adjusted to protect the most recent gains in the Fund.

The CLS Shelter Fund can be incorporated into portfolios in a variety of ways, including:

- allocating 10-30% of a diversified portfolio to the Fund.

- utilizing the Fund as a less volatile equity position in a portfolio.

- adding strategy diversification by switching allocation from stocks and bonds to the Fund.

- using the Fund within a tactical portfolio.

Portfolio Manager

Portfolio Manager: CLS utilizes a team approach for management of the Fund and from the team, the Fund is assigned co-portfolio managers who are primarily responsible for the day-to-day management of the Fund’s portfolio. Rusty Vanneman, CFA, Chief Investment Officer of CLS, Gene Frerichs, Senior Investment Performance Analyst, Jackson Lee, CFA, Quantitative Investment Research Analyst, and Case Eichenberger, Client Portfolio Manager share primarily responsibility for the day-to-day management of the Fund’s portfolio. Mr. Vanneman has served as Co-Portfolio manager of the Fund since February 2018. Mr. Frerichs has served as Co-Portfolio manager of the Fund since September 2017. Mr. Lee has served as Co-Portfolio Manager of the Fund since February 2018. Mr. Eichenberger has served as Co-Portfolio Manager of the Fund since February 2018.

There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses.

CLS Shelter Fund is a fund of funds meaning it invests in underlying mutual funds and exchange-traded funds (“Underlying Funds”). As a result, the Fund indirectly bears investment management fees of the underlying funds in addition to the fees and expenses of the Fund. In some instances it may be less expensive for an investor to invest in the underlying funds directly. There is also a risk that investment advisers of those underlying funds may make investment decisions that are detrimental to the performance of the Fund. Investments in underlying funds that own small- and mid-capitalization companies may be more vulnerable than larger, more established organizations. Investments in underlying funds that invest in foreign equity and debt securities could subject the Fund to greater risks including, currency fluctuation, economic conditions, and different governmental and accounting standards. The Fund also invests in U.S. government zero coupon bonds which can cause the value of your investment in the Fund to fluctuate with changes in interest rates. Long-term bonds are generally more sensitive to interest rate changes than short-term bonds. Because zero coupon bonds do not pay current income, their prices can be very volatile when interest rates change.